Blog

Learn all you need to know about Louisiana Medicare Plans, Medigap, Medicare Supplement, and Medicare Advantage Plans.

Best Medicare Advantage Plan Find the Perfect Coverage

When it comes to finding the best Medicare Advantage Plan, it is crucial to comprehend the various types of plans and enrollment periods that are accessible to you. Medicare Advantage Plans, also known as Medicare Part C, offer an alternative approach to healthcare coverage compared to Original Medicare.

They provide additional benefits and options that can better suit your unique healthcare needs. There are several types of Medicare Advantage Plans to choose from, but it is important to carefully consider your options and enroll in the best Medicare Advantage Plan for your specific needs.

Choosing the Best Medicare Advantage Plan

When choosing the best Medicare Advantage Plan, it is important to take into account various factors. First, it's important to understand what Medicare Advantage Plans are and how they work with Original Medicare.

Medicare Advantage Plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare.

These plans provide additional coverage beyond what is offered by Original Medicare, including prescription drug coverage (Medicare Part D) in many cases. To choose the best Medicare Advantage Plan, consider exploring the different types of Medicare Advantage Plans and finding the one that suits your needs, including the Original Medicare and Part D coverage options.

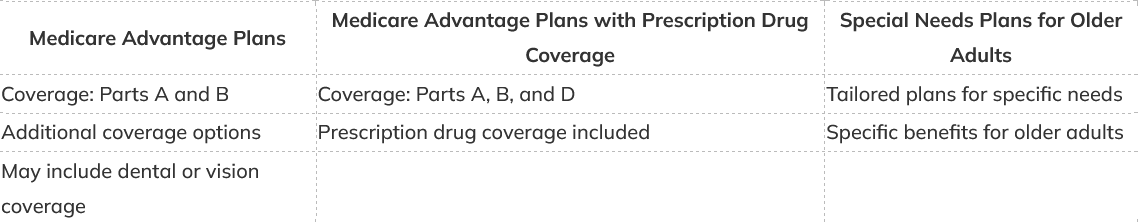

Exploring Different Types of Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, are a popular choice for older adults looking to supplement their Original Medicare coverage. These plans offer a comprehensive package that includes all the benefits of parts A and B, and often go beyond with additional coverage options.

They can include prescription drug coverage (Part D) and extra benefits such as dental or vision coverage. When looking into different Medicare Health Plans, it's crucial to understand the available plans such as Medicare Advantage Plans that cover parts A and B, Medicare Advantage Plans that include prescription drug coverage (Part D), and special needs plans tailored to the specific needs of older adults.

Understanding the Benefits of Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, offers a broad range of benefits that go beyond what is provided by Original Medicare. These comprehensive plans not only cover prescription drugs but also offer additional advantages that can greatly improve your healthcare experience.

To take advantage of these benefits, you can enroll in Medicare Advantage Insurance during the annual enrollment period. Before you enroll in a Medicare Health Plan, it is essential to understand the eligibility requirements and select the plan that best suits your needs, including prescription drug coverage and any deductibles associated with the plan you choose.

Enrolling in a Medicare Advantage Plan

Can be a complex decision, especially for individuals with special needs. With the right information, you can make an informed choice that suits your healthcare needs.

Medicare Advantage, also known as Medicare Part C, offers additional benefits like prescription drug coverage, making it an attractive alternative to Original Medicare.

When it comes to Medicare Advantage Plans, there are various options available, each with its benefits and drawbacks.

Comparing Plan Costs and Coverage

When comparing Medicare Advantage Plans, it is essential to assess both the costs and coverage provided by each plan. Medicare Advantage Plans are private insurance plans provided by different health maintenance organizations.

These plans vary from plan to plan, meaning that their costs and coverage options may differ.

These plans serve as an alternative to Original Medicare (Parts A and B) and often include additional benefits such as prescription drug coverage and health maintenance programs. When comparing the costs of Medicare health maintenance, the costs may vary from plan to plan based on factors such as star rating, health and wellness benefits, in-network coverage, prescription drug plans, preferred provider options, and extra benefits offered by private insurance companies.

As part of the annual enrollment period, older adults can also consider Medicaid services and the options available in parts A and B of Medicare.

Maximizing Your Medicare Advantage Plan Benefits

Medicare Advantage Plans offer a comprehensive array of benefits that extend beyond the coverage offered by Original Medicare. These plans not only cover your basic healthcare needs but also offer additional perks such as prescription drug coverage and health and wellness programs.

They even provide the option to seek treatment outside of your network.

It's crucial to make an informed decision and choose the best Medicare Advantage Plan that meets your specific requirements. Take into account factors like plan options, costs, and types of Medicare Advantage Plans to determine the best Medicare Advantage Plan for your specific chronic health needs, whether you are enrolled in Original Medicare or have both Medicare and Medicaid.

Medicare Advantage Plans

Medicare Advantage Plans offer more benefits than Original Medicare.

These plans include prescription drug coverage and health and wellness programs.

Medicare Advantage Plans allow you to seek treatment outside of your network.

Consider factors like plan options, costs, and types of Medicare Advantage Plans when choosing the best one for your specific needs.

Tips for Finding the Best Medicare Advantage Plan

When it comes to finding the best Medicare Advantage Plan, there are several tips to keep in mind. First, it's important to understand the basics of these plans as an alternative to Original Medicare.

Medicare Advantage Plans, which include both HMO plans and PPO plans, offer a range of coverage options that go beyond what Original Medicare covers. These plans provide additional benefits that Original Medicare does not cover, making them an attractive choice for many individuals looking for an alternative to Original Medicare, such as HMO and PPO plans.

The benefits of Medicare Advantage Plans, including the various options within this category, make them a popular choice during the annual enrollment period for Medicare, where eligible individuals can enroll in a new plan that suits their needs.

Navigating the Medicare Advantage Enrollment Period

During the Medicare Advantage Enrollment Period, it is crucial for individuals to carefully navigate the available options and select the coverage that best suits their healthcare needs. Medicare Advantage Plans offer additional benefits beyond what Original Medicare provides, such as Medicare drug coverage and special needs plans.

Understanding the different plan types and comparing plan costs, coverage, and benefits can help you choose the right plan for you. Using tools like the Medicare Plan Finder can assist in finding a list of plans that best suit your coverage needs, Medicare benefits, Medicare drug coverage, and Medicare Advantage enrollment, helping you choose the plan type that offers additional benefits, plan costs, and SNPs to ensure you get Medicare coverage that best meets your requirements.

Medicare Advantage Enrollment

Offer additional benefits beyond what Original Medicare provides.

Include Medicare drug coverage and special needs plans.

Understanding different plan types and comparing costs, coverage, and benefits can help individuals choose the right plan.

Using tools like the Medicare Plan Finder can assist in finding plans that best suit coverage needs and requirements.

We’re Here to Help

You do not have to spend hours reading articles on the internet to get answers to your Medicare questions. Give the licensed insurance agents at Bourgeois Insurance a Call at (985) 803-8999. You will get the answers you seek in a matter of minutes, with no pressure and no sales pitch. We are truly here to help.

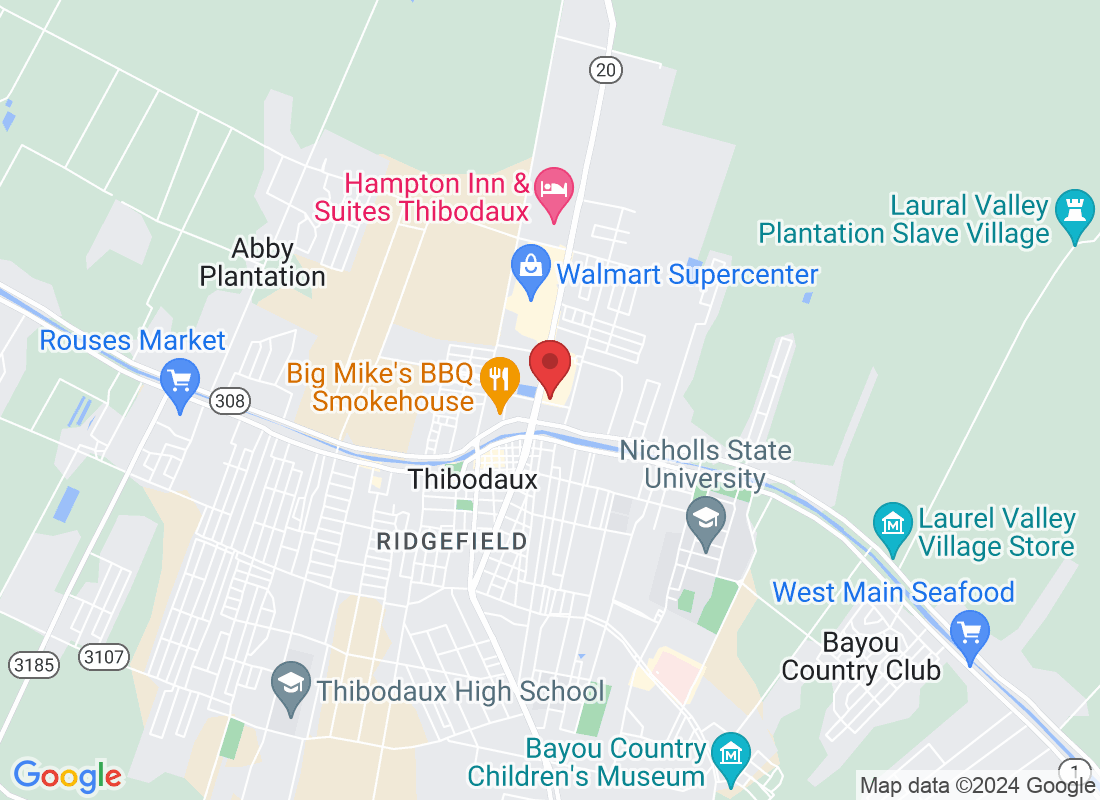

Address

Office Address

311 N Canal Blvd Thibodaux, LA 70301

Email Address

Office Number

(985) 803-8999

Resources

Contact Us

Address:

311 N Canal Blvd Thibodaux, LA 70301

Plans are insured or covered by Medicare Advantage (HMO, PPO, and PFFS) organization with a Medicare contract and/or a Medicare-approved Part D sponsor. Enrollment in the plan depends on the plan’s contract renewal with Medicare. We do not offer every plan in your area. Please contact medicare.gov or 1-800-Medicare to get information on all your options.

Bourgeois Insurance Copyright 2023 --

All Rights Reserved --